It was revealed that local sales tax collections continued to trend higher for Dublin in 2020 than 2019 when Texas Comptroller Glenn Hegar announced state sales tax revenue for Sept. 2019.

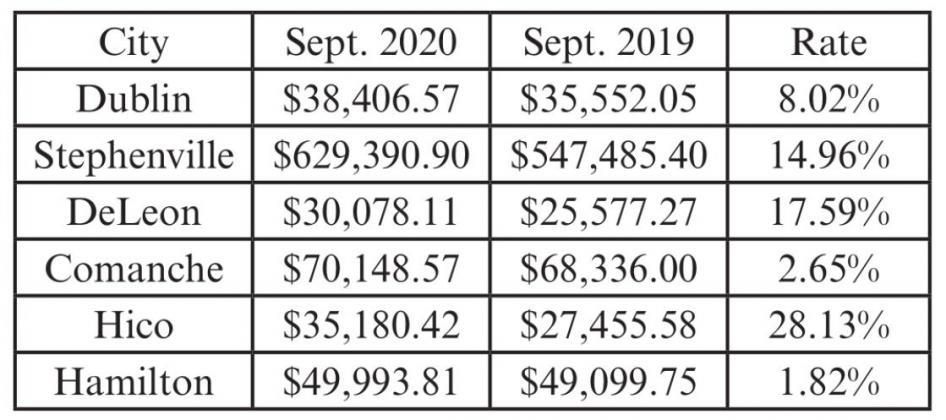

Dublin received nearly $3,000 more in sales tax collections during Sept. 2020 than Sept. 2019, thanks in part to several new businesses not open last year and reported higher activity in spending for groceries and home improvements. This month also saw increases for other local cities including Stephenville, which is up nearly 15% this month after being lower in collections for several months this year.

On the state level, Hegar said Texas sales tax revenue totaled $2.57 billion in September, 6.1 percent less than in September 2019.

The majority of September sales tax revenue is based on sales made in August and remitted to the agency in September.

“The COVID-19 pandemic and low price of crude oil continue to weigh on the Texas economy and sales tax revenue,” Hegar said. “As was the case the last month, state sales tax receipts from all major sectors, other than retail trade, were down compared with the same month last year, with the steepest declines in the oil and gasrelated sectors.

“Receipts from the information sector were down due to federal preemption of sales taxation of internet access service. While tax receipts grew from some lines of retail business, especially those related to home improvements and outdoor recreation, most of the increase from retail trade was due to remittances from online out-of-state vendors and marketplace providers who did not collect Texas tax a year ago, but which are now required to collect and remit Texas tax following the Wayfair decision and subsequent legislation passed last session.

“Pandemic-induced changes in consumer shopping behavior also were apparent in generally increased receipts from big box retailers and declines from department stores, apparel stores and other mall and strip center specialty retailers. Receipts from restaurants also remain significantly below prepandemic levels.”

Total sales tax revenue for the three months ending in September 2020 was down 2.5 percent compared to the same period a year ago. Sales tax is the largest source of state funding for the state budget, accounting for 60 percent of all tax collections. The effects of the COVIDrelated economic slowdown also were evident in some other sources of revenue in September 2020.

Texas collected the following revenue from other major taxes:

motor vehicle sales and rental taxes — $454 million, up 4.3 percent from September 2019;

motor fuel taxes — $294 million, down 9.7 percent from September 2019;

oil production tax — $227 million, down 31.9 percent from September 2019;

natural gas production tax — $71 million, down 28.1 percent from September 2019;

hotel occupancy tax — $34 million, down 36.9 percent from September 2019; and

alcoholic beverage taxes — $78 million, down 33.7 percent from September 2019.